Fintech Environment with Michael Walsh

Podcast: Play in new window | Download

Subscribe: RSS

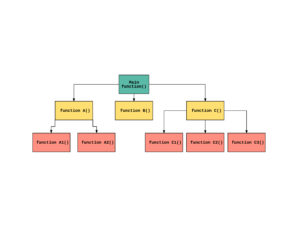

Computer systems consume memory, CPU, battery, data, and network bandwidth as inputs. These systems provide value for the end user by delivering information, virtual objects, and physical products as outputs. Another fundamental resource that is becoming easier to consume as input is money. There are also new outputs–financial constructs that are made possible by cloud computing, machine learning, and cryptocurrencies.

This is why so much opportunity exists in fintech. Money has always been a flexible tool for brokerage between humans. But as recently as the early 2000s, the interfaces between money and computers have been clunky and inflexible. Engineers that wanted to build financial systems around money had to work directly with banks and credit card processors.

More recently, there has been an explosion in new APIs and completely new financial primitives like cryptocurrencies. In the year 2000, a well-funded team had to struggle to put together a basic ecommerce company. Today, a blue ocean of opportunity has opened up for entrepreneurs building businesses around lending, insurance, underwriting, banking, and every other microcosm of the financial system.

Michael Walsh is a general partner and co-founder of Green Visor Capital. In today’s episode, he described his perspective on the modern fintech environment, and what the future holds.

Transcript

Transcript provided by We Edit Podcasts. Software Engineering Daily listeners can go to weeditpodcasts.com/sed to get 20% off the first two months of audio editing and transcription services. Thanks to We Edit Podcasts for partnering with SE Daily. Please click here to view this show’s transcript.