Episode Summary: 1inch: The Super Liquider DEX Aggregator

As Bitcoin and other cryptocurrencies gained value in 2010, exchanges popped up so that people could extract value from these blockchain based currencies. However, the failure of Mt. Gox in 2014 and several other prominent exchanges illustrated the fallacies and weakness of centralized exchanges.

The fact that large corporations had custody of individuals’ wallets and therefore their bitcoin presented not only large security concerns but also was antithetical to the decentralized, trustless philosophy that blockchains were trying to promote. The failure of centralized exchanges combined with the proliferation of ERC-20 standard and the subsequent tokens cemented the need for a blockchain-based exchange that gave users the ability to exchange various tokens.

Decentralized exchanges, or DEXs, solved this need. Early DEX’s were crude smart contracts that operated on a simple order book principle, where buyers and sellers manually submitted their orders and a smart contract kept track of them.

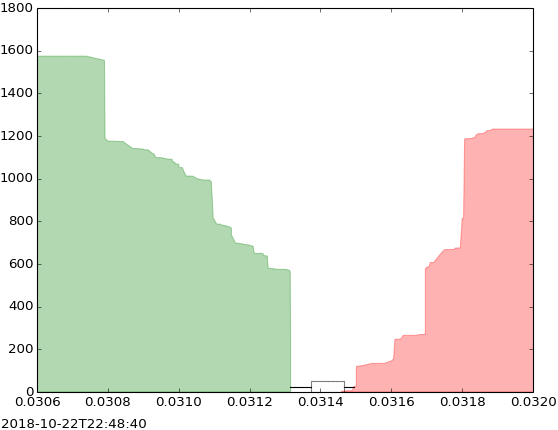

This had two main problems. The first was that it was extremely costly in terms of gas. You had to pay gas in order to submit a trade that may never get filled and pay again when the trade was executed. This was eventually solved by moving order creation off-chain. The second problem was the reliance on market-makers to add liquidity to a market. This problem was eventually solved through the use of automated market makers, or AMM. However both of these improvements did not solve the fundamental issue that the more volume you wanted to trade, the worse price you would get. This price disparity, or slippage, was becoming more and more of a problem as the ecosystem grew and began to attract a larger amount of capital. 1inch and other DEX aggregators solve this problem.

This had two main problems. The first was that it was extremely costly in terms of gas. You had to pay gas in order to submit a trade that may never get filled and pay again when the trade was executed. This was eventually solved by moving order creation off-chain. The second problem was the reliance on market-makers to add liquidity to a market. This problem was eventually solved through the use of automated market makers, or AMM. However both of these improvements did not solve the fundamental issue that the more volume you wanted to trade, the worse price you would get. This price disparity, or slippage, was becoming more and more of a problem as the ecosystem grew and began to attract a larger amount of capital. 1inch and other DEX aggregators solve this problem.

1inch was created at Hackathon in 2019 as a simple information aggregator. It wanted to aggregate DEX prices by indexing available DEX to provide a price comparison to users looking to trade a specific set of tokens. This was enabled by the permissionless nature of blockchain. Unlike the traditional web where sites like Facebook and Twitter can restrict indexers from Google and other aggregators, data on the blockchain is viewable by everyone. The UI or front end of the DEXs could be abstracted away but the brains of the operation, the smart contract, can be viewed by everyone including the initial 1inch developers. In that same hackathon, 1inch added the capability to split order volume between multiple DEX’s. By splitting one large trade on a single exchange to multiple smaller transactions across multiple exchanges, 1inch allowed traders to make the trade off between lower slippage and increased total gas price for multiple transactions. For really large trades, this tradeoff was worth it.

Today 1inch is the leading DEX aggregator supporting over 49 different DEXs on Ethereum and 12 different DEX on Binance. At its core it is still an informational service. It is not a broker, or middleware. However it has grown beyond just comparing pricing on different exchanges, rather it provides information on how to compose your swap to achieve the best possible rate. This could be as simple as choosing the DEX with the lowest rate or as complex as transacting with multiple exchanges across multiple currencies. With a front end hosted on IPFS and a governance token, 1inch is fully decentralized erasing the worries associated with centralized exchanges. It adds new DEXs in a few hours or at worst a few days. It provides better gas efficiency than even the Uniswap router. Tokens and DEXs will rise and fall but 1inch will be here to stay giving users the best price for their trade.

This article is based on an interview with Anton Bukov about 1inch. Check out that interview and others at softwareengineeringdaily.com