Infrastructure Investing with Vivek Saraswat

Podcast: Play in new window | Download

Subscribe: RSS

Software investing requires a deep understanding of the market, and an ability to predict what changes might occur in the near future. At the level of core infrastructure, software investing is particularly difficult. Databases, virtualization, and large scale data processing tools are all complicated, highly competitive areas.

Software investing requires a deep understanding of the market, and an ability to predict what changes might occur in the near future. At the level of core infrastructure, software investing is particularly difficult. Databases, virtualization, and large scale data processing tools are all complicated, highly competitive areas.

As the software world has matured, it has become apparent just how big these infrastructure companies can become. Consequently, the opportunities to invest in these infrastructure companies have become highly competitive.

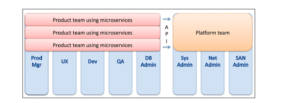

When a venture capital fund invests into an infrastructure company, the fund will then help the infrastructure company bring their product to market. This involves figuring out the product design, the sales strategy, and the hiring roadmap. A strong investor will be able to give insight into all of these different facets of building a software company.

Vivek Saraswat is a venture investor with Mayfield, a venture fund that focuses on early to growth-stage investments. Vivek joins the show to discuss his experience at AWS, Docker, and Mayfield, as well as his broad lessons around how to build infrastructure companies today.

Sponsorship inquiries: sponsor@softwareengineeringdaily.com

Transcript

Transcript provided by We Edit Podcasts. Software Engineering Daily listeners can go to weeditpodcasts.com/sed to get 20% off the first two months of audio editing and transcription services. Thanks to We Edit Podcasts for partnering with SE Daily. Please click here to view this show’s transcript.